Federal Inland Revenue Service (FIRS)

Federal Inland Revenue Service (FIRS)'s Overview

The Federal Inland Revenue Service (FIRS) is the agency of the Federal Government of Nigeria responsible for assessing, collecting, and accounting for tax and other revenues accruing to the Federal Government. Established to administer and enforce tax laws, FIRS plays a crucial role in Nigeria's economy by ensuring compliance, generating revenue for public services, and contributing to fiscal policy. Its mandate covers various taxes including Company Income Tax, Value Added Tax, Petroleum Profits Tax, Personal Income Tax for specific categories (e.g., residents of the FCT, armed forces personnel, non-residents), Capital Gains Tax, and Stamp Duties. FIRS aims to provide efficient and transparent tax administration to foster voluntary compliance and sustainable national development.

Where is Federal Inland Revenue Service (FIRS)'s Headquarters?

HQ Function

Serves as the primary national administrative and strategic command center for FIRS, overseeing all aspects of federal tax administration, policy formulation, technological integration, and stakeholder engagement.

Notable Features:

An iconic 17-story edifice with a contemporary architectural design, featuring extensive office space, modern meeting and conference facilities, a dedicated data center, and amenities designed to support a large workforce. It is one of the notable modern government buildings in Abuja.

Work Culture:

The new headquarters is designed to foster a collaborative, efficient, and technology-driven work environment. The culture emphasizes professionalism, integrity, continuous learning, and taxpayer-centric service delivery, aligning with modern public service reforms.

HQ Significance:

The new Revenue House symbolizes FIRS's commitment to modernization, efficiency, and enhanced service delivery in tax administration. It consolidates various departments under one roof, improving coordination and operational effectiveness for Nigeria's primary revenue collection agency.

Values Reflected in HQ: The modern design, technological integration, and emphasis on taxpayer service facilities within the new HQ reflect FIRS's values of innovation, transparency, efficiency, and professionalism.

Location:

While the Federal Inland Revenue Service (FIRS) primarily operates within Nigeria, its 'global presence' is manifested through international tax cooperation, engagement with global tax bodies (e.g., OECD, ATAF, WATAF), and administration of taxes for non-resident companies and individuals deriving income from Nigeria. FIRS participates in international agreements on double taxation, exchange of information, and efforts to combat tax evasion and avoidance. It also provides services and guidance for international businesses and investors regarding their tax obligations in Nigeria.

Street Address:

Revenue House, Plot 577, Cadastral Zone B05, Utako District

City:

Abuja

State/Province:

Federal Capital Territory (FCT)

Country:

Nigeria

Federal Inland Revenue Service (FIRS)'s Global Presence

Lagos, Lagos State, Nigeria

Address: Large Tax Office (LTO) Lagos, 20/22 Warehouse Road, Apapa, Lagos

To provide dedicated tax administration services to major corporations contributing significantly to national revenue, leveraging Lagos's status as Nigeria's commercial capital.

Port Harcourt, Rivers State, Nigeria

Address: Medium Tax Office (MTO) Port Harcourt, Plot 10 Aba Road, Port Harcourt, Rivers State

To ensure effective tax administration in a region critical to Nigeria's oil and gas industry, facilitating revenue collection from businesses operating within this sector and related industries.

Kano, Kano State, Nigeria

Address: Medium Tax Office (MTO) Kano, No. 1 Race Course Road, Kano

To ensure comprehensive tax coverage and service delivery in Northern Nigeria's economic heartland, promoting tax compliance and expanding the tax base in the region.

Abuja, FCT, Nigeria

Address: Revenue House, 20 Sokode Crescent, Wuse Zone 5, Abuja

To provide accessible tax services and administrative support within Abuja, complementing the functions of the new Utako headquarters and serving taxpayers in the Wuse district and surrounding areas.

Buying Intent Signals for Federal Inland Revenue Service (FIRS)

Highperformr Signals uncover buying intent and give you clear insights to target the right accounts at the right time — helping your sales, marketing, and GTM teams close more deals, faster.

Executive Team of Federal Inland Revenue Service (FIRS)

As of April 2025, Federal Inland Revenue Service (FIRS)' leadership includes:

Investors of Federal Inland Revenue Service (FIRS)

Federal Inland Revenue Service (FIRS) has been backed by several prominent investors over the years, including:

Executive New Hires/Exits in the Last 12 Months

The most significant executive change at FIRS in the last 12 months was the appointment of Dr. Zacch Adedeji as the new Executive Chairman in September 2023, succeeding Mr. Muhammad Abubakar Nami.

Departures

New Appointments:

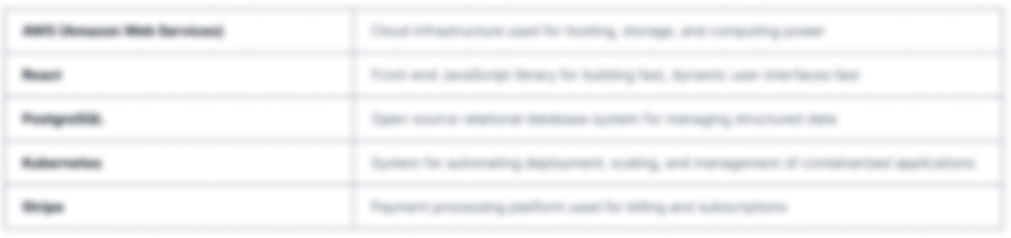

Technology (Tech Stack) used by Federal Inland Revenue Service (FIRS)

Discover the tools Federal Inland Revenue Service (FIRS) uses. Highperformr reveals the technologies powering your target accounts — helping your sales, marketing, and GTM teams prioritize smarter and close faster.

Federal Inland Revenue Service (FIRS) Email Formats and Examples

The Federal Inland Revenue Service (FIRS) typically uses a standardized email format for its official communications, commonly incorporating the employee's name or initials followed by the official domain '@firs.gov.ng'. This ensures authenticity and professionalism in communications with taxpayers and stakeholders.

[first_initial][lastname]@firs.gov.ng or [firstname].[lastname]@firs.gov.ng

Format

j.doe@firs.gov.ng or jane.doe@firs.gov.ng

Example

85%

Success rate

News and media

Vanguard News • April 29, 2024

FIRS to adopt indigenous language, pidgin for tax enlightenment

The Federal Inland Revenue Service (FIRS) announced plans to use indigenous languages and Pidgin English for tax enlightenment campaigns to improve voluntary compliance among Nigerians. Executive Chairman Zacch Adedeji stated this initiative aims to break communication barriers and ensure all taxpayers understand their obligations....more

Punch Newspapers • January 19, 2024

FIRS Targets N19.4 Trillion Revenue Collection in 2024

The Federal Inland Revenue Service (FIRS) has announced an ambitious revenue collection target of N19.4 trillion for the 2024 fiscal year. This target represents a significant increase from the N12.37 trillion collected in 2023 and underscores the agency's commitment to boosting government revenue through enhanced tax administration and compliance measures....more

Highperformr’s free tools for company research

Explore Employees by Region or Country

See where a company’s workforce is located, by country or region.

View Funding Details

View past and recent funding rounds with amounts and investors.

Understand Revenue Insights

Understand company revenue estimates and financial scale.

Track Active Job Openings

Track active roles and hiring trends to spot growth signals.

Review Product and Offerings

Discover what a company offers—products, platforms, and solutions.

Get SIC or NAICS Codes

Get the company’s official SIC and NAICS classifications.

Analyze Website Traffic Trends

Analyze visitor volume, engagement, and top traffic sources.

Discover Social Profiles and Engagement

Explore LinkedIn, Twitter, and other active social profiles.

Identify Top Competitors

Identify top competitors based on similar business traits.

Research and Discover Companies with Highperformr — Smarter, Faster

Explore companies in depth — from the tech they use to recent funding, hiring trends, and buyer signals — all in one powerful view.

Highperformr AI helps you surface the right accounts and enrich your CRM with verified company and contact insights, so your teams can prioritize and engage faster.

- Track intent signals to find buyers who are actively in-market

- Enrich contacts and companies instantly, no need to switch tools

- Automate workflows to stay ahead of every change

- Connect your CRM & tools for seamless data sync and activation

Thousands of companies, including Federal Inland Revenue Service (FIRS), are just a search away.